A credit score is an important indicator of a person’s financial health. It is a three-digit number that lenders see to grant any amount of loan to a borrower.

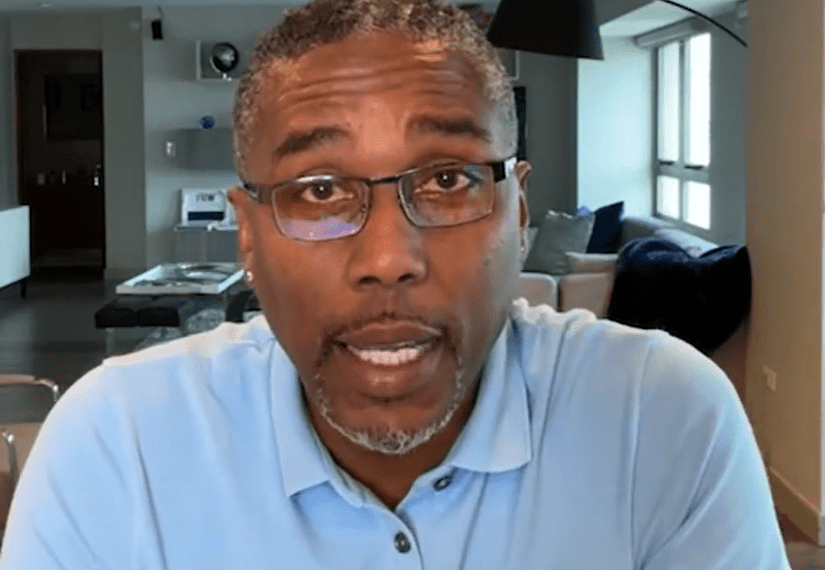

But many people don’t manage to maintain their credit score and they face many difficulties later on. Credit coach, Marvin Nathaniel Smith JR, has shared 8 steps that anyone can follow to attain a better credit score.

He is the best-selling Amazon author for his book, The Psychology of Credit. On his firm website, Dkrgroupfunding.com, he offers a free consultation to teach about fixing the credit score.

Analyze Credit Reports Regularly

Reviewing a credit score regularly can help a person acknowledge what exactly works to improve the credit score. So, it is advised to analyze credit reports regularly to improve a credit score.

Timely Bill Payments

Payment history leaves a strong impact on credit score so it is necessary to pay the bills on time to attain a good credit score.

Focus on Frequent Payments

Making frequent bill payments is a great way to boost your credit score. Paying bills twice a month leads to a significant improvement in credit score.

Pay Down the Card Closest to its Limit First

Paying down the card with a balance closes to its limit first leaves a great impact on improving the credit score.

Use Credit Monitoring Services

Marvin Nathaniel Smith JR recommends using credit monitoring services to track the changes in a credit score over time.

Maintain a Long Credit Card History

Keeping a credit card unused for a long time and avoiding opening a new one can form a strong impression on the minds of lenders.

Reduce Overall Credit Utilization Ratio

By reducing the overall credit utilization ratio, it is possible to improve the credit score. It can be done by setting higher credit limits.

Check for any Error in a Credit Report

Removing errors in a credit report after reviewing it can also improve the credit score for a person.